Lets talk about The Renegades Guide .

Welcome, renegades and degen. economic enthusiasts, to a journey through the cosmos of economics, where the dense tome of Ludwig von Mises meets the futuristic gamble of Michael Saylor on Bitcoin. Strap in your economic seatbelts because we’re about to dive into a narrative that’s part “Human Action,” part “Space Odyssey.”

The Misesian Manifesto

First, let’s set the scene with a bit of backstory. Ludwig von Mises, a man whose name sounds like it could be an alien currency, wrote “Human Action: A Treatise on Economics” in 1949. This book isn’t just any old economic text; it’s the economic equivalent of the Hitchhiker’s Guide to the Galaxy – vast, insightful, and occasionally baffling. Mises argued that economic phenomena are the result of individual human actions, driven by subjective value judgments. He’s essentially saying that economics isn’t about numbers or graphs (though those are fun, too) but about the choices people make.

Enter Michael Saylor: The Bitcoin Pioneer

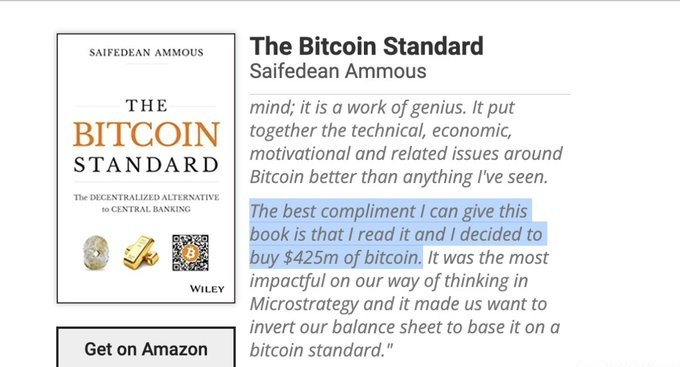

Now, let’s fast forward to the 21st century, where Michael Saylor, the CEO of MicroStrategy, decides to take a page out of Mises’ playbook. In a move that was either brilliant or bonkers (only time, the ultimate economist, will tell), Saylor announced that MicroStrategy would start buying Bitcoin in droves. By 2025, they’ve amassed over 200,000 Bitcoins, which, if you’re counting, is a lot of digital coins for one company to hold.

How Mises Meets Bitcoin

- Human Action in Digital Form: Mises talks about human action being the cornerstone of economic activity. Saylor’s decision to invest in Bitcoin is a classic case of human action – choosing Bitcoin over traditional cash reserves based on his judgment of its future value. It’s like choosing to invest in a spaceship rather than a horse-drawn carriage because, well, space is the future, right?

- Subjective Value and Bitcoin: Mises emphasized that value is subjective. What’s the value of Bitcoin? Well, that depends on who you ask. For Saylor, Bitcoin represents not just currency but a store of value, a hedge against inflation, and a bet on technological advancement. This aligns with Mises’ view that value isn’t inherent but derived from individuals’ perceptions and actions.

- The Free Market Experiment: Mises was a staunch advocate for free markets. Bitcoin, in its most ideal form, is a decentralized, free market where no single entity like a government can devalue your earnings through inflation. Saylor’s move can be seen as a grand experiment in Misesian economics – testing the waters of a currency free from central control.

- Praxeology in Practice: Mises introduced praxeology, the study of human action. Saylor’s strategy with Bitcoin is praxeology in action. He’s not just passively holding assets; he’s actively shaping MicroStrategy’s future by betting on what he perceives as the next big economic paradigm shift.

The Cosmic Conclusion

FREQUENTLY ASKED QUESTIONS.

Direct control and manipulation of the money supply (M2) by A Central Bank.

Government spending (Theft) and taxation (Extortion).

Simply when they can no longer function together in order to achieve their intended goal. Its like when the break pedal suddenly starts acting like the gas pedal.

**Disclaimer**

Cryptocurrencies and ICOs are all the rage these days, with everyone from celebrities to your next door neighbor looking to get in on the action. However, it’s important to remember that investing in cryptocurrencies and ICOs is highly risky and speculative. The prices of these assets can be incredibly volatile, and there’s no guarantee that you’ll make any money by investing in them. In fact, you could easily lose everything that you put into them. So if you’re thinking about investing in cryptocurrencies or ICOs, make sure that you understand the risks involved and only invest what you can afford to lose.