- HI THERE DENIZENS, AND WELCOME BACK!

- SO, LET'S START WITH MACRO INVESTING; WHAT IS IT?

- WHY SHOULD IT MATTER?

- SO WHAT ARE THESE MACRO INVESTMENT INDICATORS?

- 1. CENTRAL BANK OF THE GLOBAL RESERVE CURRENCY

- 2. INFLATION

- 3. DEBPT TO GDP RATIO

- 4. REVERSE REPO FACILITY

- 5. INTEREST RATES

- 6. TECHNICAL ANALYSIS

- SO, WHAT MACRO DO WE LOOK AT FIRST?

- Outlook and final thoughts;

- Frequently Asked Questions.

- Refferences

HI THERE DENIZENS, AND WELCOME BACK!

- HI THERE DENIZENS, AND WELCOME BACK!

- SO, LET'S START WITH MACRO INVESTING; WHAT IS IT?

- WHY SHOULD IT MATTER?

- SO WHAT ARE THESE MACRO INVESTMENT INDICATORS?

- 1. CENTRAL BANK OF THE GLOBAL RESERVE CURRENCY

- 2. INFLATION

- 3. DEBPT TO GDP RATIO

- 4. REVERSE REPO FACILITY

- 5. INTEREST RATES

- 6. TECHNICAL ANALYSIS

- SO, WHAT MACRO DO WE LOOK AT FIRST?

- Outlook and final thoughts;

- Frequently Asked Questions.

- Refferences

SO, LET'S START WITH MACRO INVESTING; WHAT IS IT?

Macro investing, also known as “Top-Down” investing, is all about taking a big-picture view of the global economy and trying to profit from it. It’s an investment strategy that looks at the big picture of the economy and makes investment decisions accordingly. Macro investors look at factors like central bank policy, inflation, GDP growth, and currency movements to try to get an idea of where the economy is headed. They then make bets on assets that they think will do well in that environment. Macro investing is often compared to playing chess, because investors have to think several moves ahead to be successful. It’s a high-stakes, high-reward game, and it’s not for everyone. But if you’re up for the challenge, macro investing can be a great way to profit from the ups and downs of the global economy.

WHY SHOULD IT MATTER?

“Roses are Red, Violets are Blue, Inflation is theft and Taxes are too”-Robert Breedlove

As the non-bitcoin highly speculative world of digital assets becomes more mainstream, it’s important for Crypto Jedi to understand the financial markets, market value, price action, and the macroeconomic forces that can affect them.

That’s because, unlike stocks or bonds, digital assets don’t have a centralized exchange where prices are set. Instead, prices are determined by supply and demand in the market. And those supply and demand dynamics can be affected by macroeconomic factors.

For example, if there’s a recession and people start selling off their assets to raise cash, that could lead to a drop in prices for digital assets.

On the other hand, if central banks start printing money to stimulate the economy again, that will lead to higher inflation and higher prices for all most assets, including digital assets. So, Crypto Jedi need to understand the macroeconomic environment in which they’re investing.

SO WHAT ARE THESE MACRO INVESTMENT INDICATORS?

As more companies become invested in this industry the “high-risk” reputation of blockchain technology will change as millions of people begin to realize its utility and advantages.

This means that crypto won’t be on the fringes forever. It will eventually work its way up to the highest level of institutional authorities and will become mainstream.

The Crypto Jedi needs to have a respectful understanding of their asset(s) from a top-down approach, and I mean the very top.

1. CENTRAL BANK OF THE GLOBAL RESERVE CURRENCY

This is US Federal reserve AKA “The Fed” and the global reserve currency is currently the US dollar.

What inportant to know is that the “federal reserve” is not federal and it has no reserve.

As mentioned before, The Fed has financial leverage and power over the direction of the global economy. They can print money, set interest rates, and buy or sell assets. So, it’s important to pay attention to what central banks are doing and to pay attention to their policies:

Formal Policy- maximum employment; and, stable prices, meaning low, stable inflation. (Yes, we’ve all been brainwashed into believing the lie that inflation is necessary-but we’ll get to that another time)

Informal Policy- maintain status as the global reserve currency.

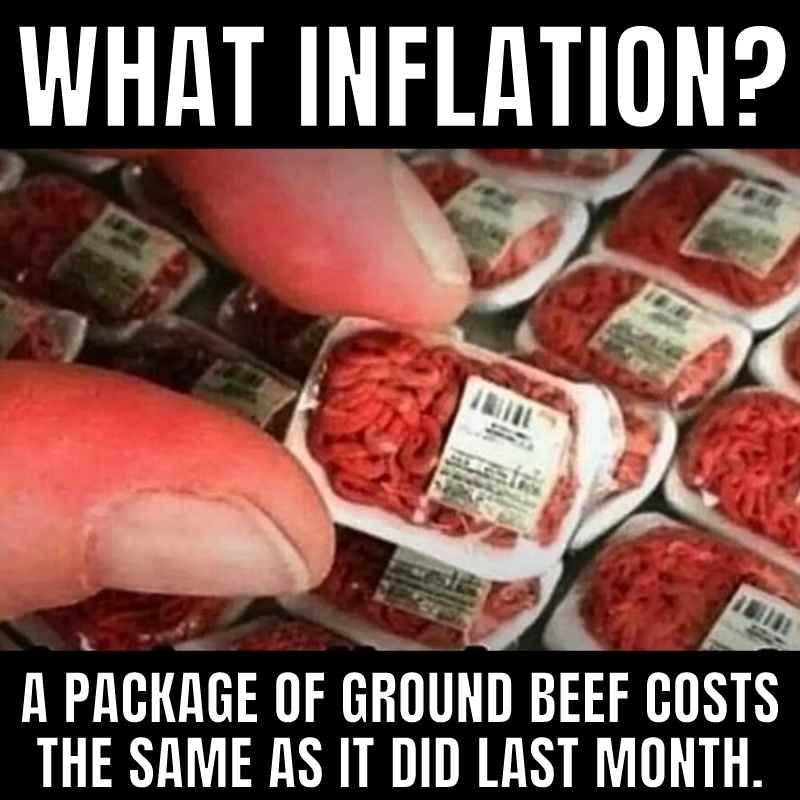

2. INFLATION

Although the Institutional definition of Inflation is – a measure of how fast prices are rising- you know how we feel about their track record of integrity and honesty.

As such, The Crypto Medium and other Jedi understand the true value of most things (without a fixed or limited supply) are deflationary (meaning they get “cheaper”). The reason for this is that technology creates this force effect.

But since Keynesian economic theory calls for fiat money to be constantly printed from nothing, the real definition of inflation is – a measure of how our money is losing its value in relation to things.

Regardless, of what definition you prefer, It’s important to watch because it dictates FED policy and, in turn, can have a big impact on asset prices.

3. DEBPT TO GDP RATIO

In short, this is simply how much money a country is making (gross domestic product (GDP)) vs how much it’s spending (public debt). So this one is a little tricky but we’ll do our best to make it easy to understand.

GDP stands for Gross Domestic Product and it’s a measure of how fast the economy is growing. The Debt to GDP ratio is a measure of how much debt the government has compared to the size of the economy.

The World Bank found that countries whose debt-to-GDP ratios exceed 77% for prolonged periods experience significant slowdowns in economic growth. In other words, they spend more than they make.

So, if the economy is growing quickly, the debt-to-GDP ratio will be lower. If the economy is growing slowly, the debt-to-GDP ratio will be higher. It’s important to watch because it can affect inflation, interest rates, and asset prices.

4. REVERSE REPO FACILITY

The Overnight Reverse Repurchase Agreements Facility, otherwise known as “The Reverse Repo” facility, is a little more technical.

Reverse Repo is a short-term agreement to purchase securities in order to sell them back at a slightly higher price. Repos and reverse repos are used for short-term borrowing and lending, often overnight. Central banks use reverse repos to add money to the money supply via open market operations.

it’s important to understand because it can have an impact on asset prices. A Reverse repo facility is a tool that the Fed uses to control the money supply.

It allows banks to park their excess cash at the Fed overnight and earn interest on it. The way it works is that the Fed sells securities to the banks and agrees to buy them back the next day. This has the effect of taking money out of the system and reducing the money supply.

When the reverse repo facility is used, it’s usually because the Fed wants to tighten monetary policy (reduce the money supply). This can have an impact on asset prices, so it’s important to be aware of it.

5. INTEREST RATES

This is another pretty self-explanatory one but it’s still important to watch. Interest rates are the cost of borrowing money. They have a direct impact on asset prices, so it’s important to be aware of them.

They also impact the unemployment rate is a measure of how many people are looking for work but can’t find it. It’s important to watch because it can affect inflation, interest rates, and asset prices.

6. TECHNICAL ANALYSIS

This is the study of past price movements in order to identify patterns and make predictions about future price movements.

Macro technical analysis can be applied to any asset, but it’s especially useful for digital assets because of their high volatility.

If you’re new to TA, I’ve organized the links for you to start at the first (top) and work your way down.

My intention is for you to FIRST grasp an understanding of the super big, global “MACRO” economic perspective, THEN work your way into the weeds. This is for your understanding and will help you see the “big picture”.

To gain a more balanced and objective truth. Hopefully, you’ll learn enough here to be able to watch the news, wherever you are and scoff at the narrative because you’re able to see through the “veil”.

There are a few key indicators that all investors should watch. I’ve created a link list of a few of the most important ones from the global Macro power brokers down to specific low-cap altcoin projects :

THE JEDI CORE STGRATEGY

The Crypto Jedi believe in a fundamental “reimagining of human civilization” where Bitcoin or something very similar is at the center of our monetary system. Money that has its integrity rooted in the laws of physics and is highly resistant to politics because it’s dematerialized and decentralized.

Bitcoin optimizes our will-to-power and therefore lets us be free and all crypto Jedi want this outcome.

DOLLAR-COST-AVERAGE

There are a variety of ways to approach macro investing, but one of the most important things to remember is that it’s all about understanding how the different pieces of the puzzle fit together. That means keeping an eye on things like interest rates, inflation, employment data, and other economic indicators.

The goal is to find investments that will benefit from changes in the overall economy. For example, if you believe that interest rates are going to rise, you might, short-term hold/save some of the global reserve currency (currently USD), invest in certain bonds, or perhaps stocks of companies that borrow money.

On the other hand, if you think inflation is going to increase, you might invest in tech stocks, commodities like gold, and of course crypto like Bitcoin….clearly Bitcoin.

No one can predict the future with 100% accuracy, so there’s always some risk involved in macro investing. But if you do your homework and make smart investment choices, you can potentially reap big rewards, specifically if you dollar-cost-average and your strategy is long-term.

CHARTING AND TA

Technical analysis (TA) and charting are two important tools that all Jedi need to know about. Technical analysis is the study of past price movements to identify patterns and predict future price direction.

Charting is the process of creating visual representations of data, which can be used to identify trends and make trading decisions.

If you’re new to trading, it’s important to learn about technical analysis and charting. These are two essential tools that all traders need to know about.

SO, WHAT MACRO DO WE LOOK AT FIRST?

With all of this going on, it’s important to have a firm understanding of global events and how macroeconomics influence them. Yes I said it, I believe Macro influences global events, not vice versa.

So, if you’re interested in macro investing, these are the things you need to be aware of as all international major stories could have a big impact on the global economy, and your portfolio.

Outlook and final thoughts;

The Fed’s actions will have a big impact on global markets, so it’s important to stay up-to-date on the latest news and developments. Additionally, technical analysis and charting are two essential tools that all traders need to know about. By understanding macroeconomics and using these tools, you’ll be better prepared to make informed trading decisions in the crypto markets.

Frequently Asked Questions.

In short, the Fed’s actions will have a major impact on the markets. So, it’s important to stay up-to-date on the latest news and developments. This way, you’ll be better prepared to make informed trading decisions.

Technical analysis is the study of past price movements to identify patterns and predict future price direction. It’s best used with tools and predictors of human emotion and behavior

The current crypto crash could be good for the long-term growth of the industry because it’s attracting more attention from institutional investors.

**Disclaimer**

Cryptocurrencies and ICOs are all the rage these days, with everyone from celebrities to your next door neighbor looking to get in on the action. However, it’s important to remember that investing in cryptocurrencies and ICOs is highly risky and speculative. The prices of these assets can be incredibly volatile, and there’s no guarantee that you’ll make any money by investing in them. In fact, you could easily lose everything that you put into them. So if you’re thinking about investing in cryptocurrencies or ICOs, make sure that you understand the risks involved and only invest what you can afford to lose.