SO, HOW IS BITCOIN AN ANTIDOTE TO TYRANNY?

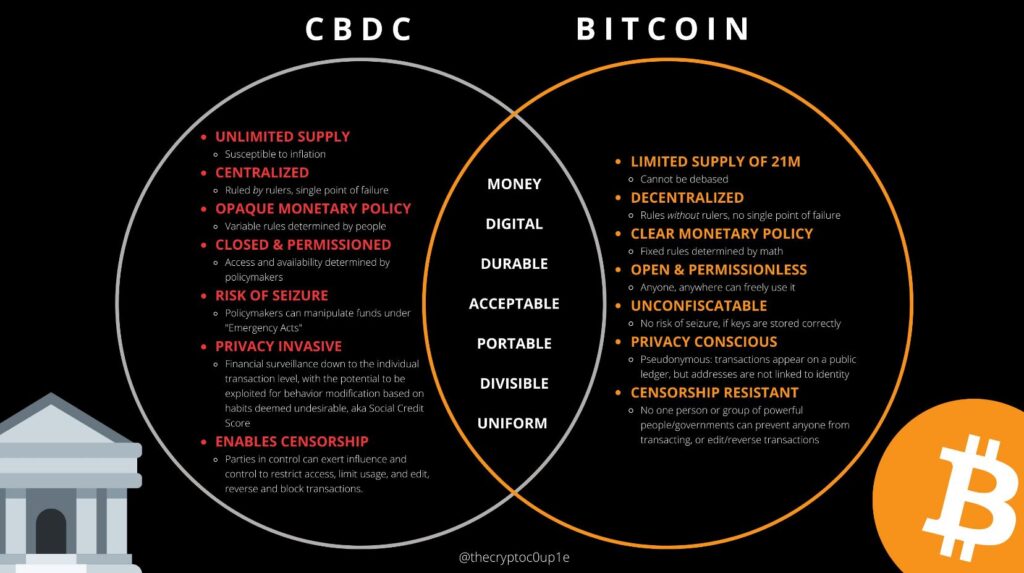

Bitcoin is the antidote to the Central Bank Digital Currency (CBDC), that’s how! CBDC’s are the ideal form of centralized and non-transparent digital mass surveillance fiat “smart” currency. Bitcoin, on the other hand, is the first engineered sovereign monetary system in the history of the human race. A thermodynamically unstoppable peer-to-peer decentralized network and real estate bank in cyberspace that’s the first asset class to transcend all forms of government manipulation and to exist outside of central banks. It’s Unique because, for the most part, it removes the middlemen and gives more power to the common person. This democratization of money is similar to the adoption of the internet and innovation of the “Dot.Com” boom in the 90s.

BACKGROUND:

UNCOMMUNIST MANIFESTO

Governments and financial institutions around the world have the integrated power and authority to manipulate their monetary systems, access individual bank accounts, and control access to these accounts.

Although achieving this capability, largely with “tax revenue” is rather reprehensible, it’s perhaps widely accepted and tolerated in our Western nations, perhaps due to the parliamentary democratic process. But this ability in the hands of tyrannical and oppressive regimes makes it an ominous and scary proposition.

Understanding the terrible and escalating situation in Ukraine, Russia, and Western Europe is occupying all of our minds and hearts, I found my thoughts drifting south-south-east to the situation in Turkey and Lebanon this past thanksgiving weekend.

The country is in chaos with political corruption and economic instability, perhaps the worst economy the nation has ever seen. I have heard first-hand stories of people who had their whole bank accounts seized and stolen by their corrupt governments and institutions.

WHAT DO YOU THINK MONEY IS?

Do you think it’s in a “bank” somewhere? Do you think your government will always be there to help you if things go wrong?

What if I told you that, actually, “your money” is a fiction created by the state which can and often does simply disappear when convenient for them?

“Your money” is a “government-issued debt certificate, undergoing slow-motion default through inflation”-Robert Breedlove.

Your money is not yours, and when it enters the bank, it’s definitely not yours. Banks are not really the”safe” spaces you think they are. And that, if push comes to shove, your bank and government will confiscate your assets, potentially leaving you with nothing.

What then?

ENTER BITCOIN

In the face of tyranny, bitcoin gives hope. Bitcoin is an asset outside of the control of any government, financial institution or banking system. It can be a global virtual currency that can’t be confiscated or manipulated into inflation. It is a new form of money that people are slowly but surely beginning to understand and adopt.

When your bank account is seized, or your country’s currency begins to rapidly lose value, you can always turn to bitcoin. With bitcoin, you are in control of your own money. No one can take it from you.

When Bitcoin first came on the scene, it was lauded as a way to take power away from central authorities and put it back into the hands of the people. And while that is still one of its most appealing aspects, it has also been proven to become an effective tool against and, in fact, a direct threat to tyranny.

In a tyrannical regime, the ruling party or government has complete control over its financial system. They can .print money at will, inflate the currency, and make it nearly impossible for their citizens to move their money out of the country.

But with Bitcoin, citizens can take back control of their finances. Bitcoin is decentralized, so no government or institution can control it. And because it’s digital, it’s easy to send and receive Bitcoin anywhere in the world.

So for anyone living under a tyrannical regime, Bitcoin can be a lifeline. It gives them a way to preserve their wealth by keeping their money safe and resisting the disastrous effects of inflation.

In 2021, the Lebanese Lira fell by 90%. Authorities would call this inflation, but it’s most certainly a collapse.

In this way, Bitcoin would give people a way to resist the attempts at tyrannical control by their governments.

As such, in the case of Lebanon, had these Lebanese civilians had their money invested in bitcoin, they would still have a portion of it at their disposal.

The reason for that is, bitcoin and other cryptocurrencies are built on the blockchain on the internet and bitcoin is a decentralized monetary system that would have made it impossible for governments to seize individual wealth.

They could have then escaped the country without running the risk of getting having their money confiscated.

BUT COULD BITCOIN BE THE REAL ALTERNATIVE?

In Bitcoin’s case, there are only 21 million that will ever be in existence and with its limited supply completely outside of institutional control.

Therefore, governments and institutions can custody or manipulate the values by increasing supply through inflation, as they do with fiat currency.

In the case of the people of Turkey and Lebanon; they held US dollars and local currency, two fiat currencies that governments and institutions can easily manipulate because they have the power to print money, decrease purchasing power and drive up inflation.

Before social media, only mainstream media outlets and major publishers could distribute content and information. Today, we all have the same ability as long as we have a phone and some internet access.

This democratization of media has evened out the playing field and put the power into the hands of the common person.

This is known as deflation or the “deflationary quality” of technology. Why should our money be any different? why does it need to endlessly inflate?

Short answer, it doesn’t.

“Bitcoin = freedom”

FINAL THOUGHTS

Bitcoin offers a unique combination of properties that make it an attractive asset to own, especially in times of political unrest, or when living under the thumb of increasingly oppressive regimes.

Bitcoin is a decentralized digital currency without a central bank or single administrator and can be sent from user to user on the peer-to-peer bitcoin network without the need for intermediaries.

Transactions are verified by network nodes through cryptography and recorded in a publicly distributed ledger called a blockchain.

There is no central authority that controls Bitcoin. The network is powered by its users with no middlemen or intermediaries.

Bitcoin transactions are secure, irreversible, and do not contain customers’ sensitive or personal information. This protects merchants from losses caused by fraud or fraudulent chargebacks, and there is no need for PCI compliance.

Bitcoins can be sent anywhere in the world, 24/7. The network is global and not limited by borders or business hours.

If you’re already living in a totalitarian country, then the odds are, you won’t be reading this and you likely have other problems that take priority.,

But if you’re not then acquiring bitcoin may be the type of challenge you will undoubtedly want to risk.

Frequently Asked Questions.

Bitcoin is an antidote to tyranny because it is a decentralized digital currency without a central bank or single administrator. Transactions are verified by network nodes through cryptography and recorded in a publicly distributed ledger called a blockchain. There is no central authority that controls Bitcoin. The network is powered by its users with no middlemen or intermediaries. Bitcoin transactions are secure, irreversible, and do not contain customers’ sensitive or personal information. This protects merchants from losses caused by fraud or fraudulent chargebacks, and there is no need for PCI compliance. Bitcoins can be sent anywhere in the world, 24/7. The network is global and not limited by borders or business hours.

Bitcoin can be used to fight tyranny by providing a secure, decentralized, and global financial network that is not under the control of any government or institution. Bitcoin allows people to transact without the need for intermediaries and provides a level of security and privacy that is not possible with traditional fiat currencies. Bitcoin also offers a level of censorship resistance, as it is not possible for governments or other entities to block or censor transactions.

Some of the risks of using bitcoin include volatile prices, potential scams and fraud, and the risk of losing your bitcoins if you do not properly secure your private keys.

**Disclaimer**

Cryptocurrencies and ICOs are all the rage these days, with everyone from celebrities to your next door neighbor looking to get in on the action. However, it’s important to remember that investing in cryptocurrencies and ICOs is highly risky and speculative. The prices of these assets can be incredibly volatile, and there’s no guarantee that you’ll make any money by investing in them. In fact, you could easily lose everything that you put into them. So if you’re thinking about investing in cryptocurrencies or ICOs, make sure that you understand the risks involved and only invest what you can afford to lose.