Welcome back all you beautiful degen denizens!

BITCOIN DEFINED

Bitcoin is a digital asset and a payment system invented by a person or pwersons named Satoshi Nakamoto. It is protocol layer technology whose growth resembles the internet in the 1990s. It is designed to be the best monetary network in existance. Transactions are verified by network nodes through cryptography and recorded in a public dispersed ledger called a blockchain. Bitcoin is unique in that there will only ever be a finite number of them: 21 million.

So what does that mean?

Bitcoin is a digital currency that is not issued by a central bank or backed by a government. Well, traditional currencies are inflation rates, monetary policy and economic growth indicators that influence currency value. But with bitcoin, none of that applies. Instead, bitcoin is based on a blockchain, which is a distributed digital ledger. In other words, it’s a digital chain of blocks containing information about each bitcoin transaction. When a block is uploaded to the blockchain, it becomes available to anyone looking at it. So bitcoin transactions are public records. And there you have it! Now you know everything there is to know about bitcoin.

Bitcoin: A Peer-to-Peer Electronic Cash System

A fundamental reimagining of human civilization Its integrity is rooted in the laws of physics and it’s highly resistant to politics because it’s dematerialized and decentralized. Bitcoin optimizes our will-to-power and therefore lets us be free.

Bitcoin, bitcoin, bitcoin. Say it with me now: bitcoin. How many times have you heard that word in the past year? It seems like everyone’s talking about bitcoin these days. But what is bitcoin, really? Let’s break it down.

ABSTRACT

A purely peer-to-peer version of electronic cash would allow online. payments to be sent directly from one party to another without going through a financial institution. Digital signatures provide part of the solution, but the main benefits are lost if a trusted third party is still required to prevent double-spending. We propose a solution to the double-spending problem using a peer-to-peer network. The network timestamps transactions by hashing them into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed without redoing

the proof-of-work. The longest chain not only serves as proof of the sequence of events witnessed, but proof that it came from the largest pool of CPU power. As long as a majority of CPU power is controlled by nodes that are not cooperating to

attack the network, they’ll generate the longest chain and outpace attackers. The network itself requires minimal structure. Messages are broadcast on a best effort basis, and nodes can leave and rejoin the network at will, accepting the longest proof-of-work chain as proof of what happened while they were gone.

1. Introduction

Commerce on the Internet has come to rely almost exclusively on financial institutions serving as

trusted third parties to process electronic payments. While the system works well enough for

most transactions, it still suffers from the inherent weaknesses of the trust based model.

Completely non-reversible transactions are not really possible, since financial institutions cannot

avoid mediating disputes. The cost of mediation increases transaction costs, limiting the

minimum practical transaction size and cutting off the possibility for small casual transactions,

and there is a broader cost in the loss of ability to make non-reversible payments for nonreversible services.

With the possibility of reversal, the need for trust spreads. Merchants must

be wary of their customers, hassling them for more information than they would otherwise need.

A certain percentage of fraud is accepted as unavoidable. These costs and payment uncertainties

can be avoided in person by using physical currency, but no mechanism exists to make payments

over a communications channel without a trusted party.

What is needed is an electronic payment system based on cryptographic proof instead of trust,

allowing any two willing parties to transact directly with each other without the need for a trusted

third party. Transactions that are computationally impractical to reverse would protect sellers

from fraud, and routine escrow mechanisms could easily be implemented to protect buyers.

In this paper, we propose a solution to the double-spending problem using a peer-to-peer distributed

timestamp server to generate computational proof of the chronological order of transactions. The

system is secure as long as honest nodes collectively control more CPU power than any

cooperating group of attacker nodes.

2. Transactions

We define an electronic coin as a chain of digital signatures. Each owner transfers the coin to the

next by digitally signing a hash of the previous transaction and the public key of the next owner

and adding these to the end of the coin. A payee can verify the signatures to verify the chain of

ownership.

The problem of course is the payee can’t verify that one of the owners did not double-spend

the coin.

A common solution is to introduce a trusted central authority, or mint, that checks every

transaction for double spending. After each transaction, the coin must be returned to the mint to

issue a new coin, and only coins issued directly from the mint are trusted not to be double-spent.

The problem with this solution is that the fate of the entire money system depends on the

company running the mint, with every transaction having to go through them, just like a bank.

We need a way for the payee to know that the previous owners did not sign any earlier

transactions.

For our purposes, the earliest transaction is the one that counts, so we don’t care

about later attempts to double-spend. The only way to confirm the absence of a transaction is to

be aware of all transactions. In the mint based model, the mint was aware of all transactions and

decided which arrived first. To accomplish this without a trusted party, transactions must be

publicly announced [1], and we need a system for participants to agree on a single history of the

order in which they were received.

The payee needs proof that at the time of each transaction, the

majority of nodes agreed it was the first received.

How does it work?

Bitcoin is a digital currency that is not backed by a government or central bank. Bitcoin is based on a blockchain, which is a distributed digital ledger. Blockchain is a linked body of data made up of units called blocks, which contain information about each transaction, such as the buyer and seller, time and date, total value and a unique identification code for each exchange.

Entries are connected in chronological sequence, forming a digital chain of blocks. Bitcoin is unique in that there are a finite number of them: 21 million. Once they are all mined, no more will ever be created. This could make bitcoin subject to inflation if the demand for bitcoin decreases. Currently, each bitcoin can be divided into 100 million smaller units called satoshis.

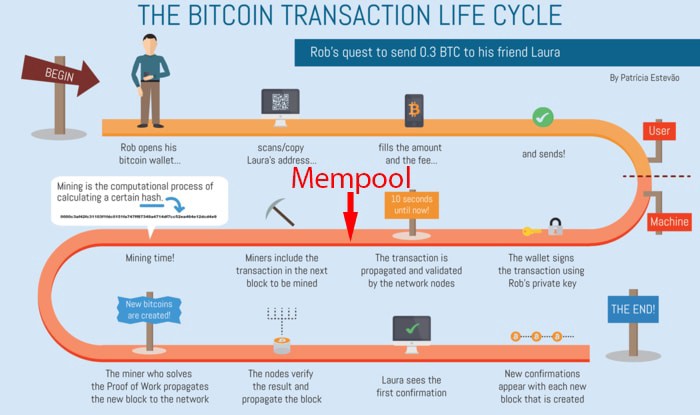

Transactions are completed using bitcoin wallets; users send and receive bitcoin by entering wallet addresses. A bitcoin wallet can be either an online service, which stores your bitcoin in the cloud, or a physical device, like a USB drive, which stores your bitcoin offline and is considered more secure. Bitcoin can be bought and sold on exchanges and traded for other currencies. The value of bitcoin fluctuates based on supply and demand. When demand for bitcoin increases, the price goes up; when demand falls, the price goes down.

A couple years ago, I would have had no idea what the blockchain was. But now, it seems like everyone is talking about it – and for good reason. The blockchain is a decentralized, digital ledger that anyone can contribute to. It’s similar to a Google Doc, in that anyone with the link can edit it. And as different individuals make changes to it, your copy is updated as well.

So why is this important? Well, it makes Bitcoin – and other cryptocurrencies – secure and trustworthy. To be included in the Bitcoin blockchain, a transaction block must be validated by the majority of Bitcoin miners. And since the unique codes used to identify users’ wallets and transactions are long random numbers, counterfeiting them is extremely difficult. So there you have it! The blockchain is secure, decentralized, and allows anyone to contribute. No wonder it’s become so popular.

The statistical randomness of the blockchain verification codes required for each transaction dramatically minimizes the likelihood of a fraudulent Bitcoin transaction being made by anyone connected to the network. At its most basic, Bitcoin is an autonomous public-key cryptosystem that facilitates the exchange of digital value among peers via a sequence of digitally signed transactions, rather than messages. The basic process flow of a Bitcoin transaction is identical to that of a series of encrypted messages found in a schematic of public-key cryptography and digital signatures.

However, the bitcoin network’s distributed ledger, known as the blockchain, uses a unique form of verification code that is nearly impossible to counterfeit or guess. As a result, bitcoin transactions are incredibly secure, and the chances of someone successfully executing a fraudulent transaction are astronomically low.

Bitcoin mining is the process of verifying and validating bitcoin transactions. As a bitcoin miner, you search for, verify, and validate bitcoin transactions from a pool of unconfirmed deals before adding them to the bitcoin network.

You confirm entries by solving mathematical puzzles, which we will get into in the succeeding sections.

In return, the system compensates you with bitcoins. While the term “mining” might conjure up images of pickaxes and coal mines, bitcoin mining is actually a very clean and low-energy process.

So, while it might not be exactly like mining for gold, it’s still a pretty interesting way to earn some bitcoins!

WHy DO they need to be mined?

Since Bitcoin mining is the process of creating new bitcoins by verifying and adding bitcoin transactions to the blockchain, the digital ledger that keeps track of all bitcoin activity.

Miners play an important role in bitcoin’s security and stability by ensuring that only legitimate transactions are added to the blockchain.

In return for their work, miners are rewarded with newly minted bitcoins. As more people begin to use bitcoin, the demand for new bitcoins grows, and so does the value of bitcoin.

This makes bitcoin mining a competitive and lucrative activity. In order to be successful, miners need expensive equipment and access to cheap electricity. T

hey also need to be able to solve complex math problems quickly. Bitcoin mining is a complex and costly process, but it is essential for the continued growth and stability of the bitcoin network.

How Do You Buy Bitcoin?

Don’t invest in cryptocurrency if you don’t understand it.

All investments involve risk, but investing in cryptocurrency is especially risky because its value can fluctuate so much. It’s important to do your research before investing and only invest money that you’re willing to lose.

Another thing to keep in mind is that cryptocurrency exchanges can be hacked, so make sure you use a reputable exchange and always use two-factor authentication. Also, be careful about phishing scams- never give out your personal information or login credentials to anyone.

If you’re still interested in investing in cryptocurrency, here are a few tips to help you do it safely:

1. Choose a strong password and don’t use the same password for different websites.

2. Use a reputable cryptocurrency exchange like Coinbase.

3. Make sure you enable two-factor authentication on your account.

4. Be careful about phishing scams- don’t click on links or download attachments from unknown emails.

5. Don’t invest more money than you’re willing to lose.

**6. Get your bitcoin into a self custody wallet**