- HI EVERYONE, AND WELCOME BACK! SO WHAT IS DEFI?

- bACKGROUND:

- So whats the big deal with DEFI exactly?

- Examples of DeFi platforms:

- dapps

- DAOs:

- Exchanges:

- Lending Platforms:

- Wealth Management Platforms:

- What’s the difference between DeFi and CeFi?

- As with any emerging technology, there are some risks associated with DeFi:

- What are some of the most popular defi applications?

- What are the benefits of using defi applications?

- Outtlook and final thoughts;

- Frequently Asked Questions.

- UP NEXT

- REFERENCES

HI EVERYONE, AND WELCOME BACK! SO WHAT IS DEFI?

- HI EVERYONE, AND WELCOME BACK! SO WHAT IS DEFI?

- bACKGROUND:

- So whats the big deal with DEFI exactly?

- Examples of DeFi platforms:

- dapps

- DAOs:

- Exchanges:

- Lending Platforms:

- Wealth Management Platforms:

- What’s the difference between DeFi and CeFi?

- As with any emerging technology, there are some risks associated with DeFi:

- What are some of the most popular defi applications?

- What are the benefits of using defi applications?

- Outtlook and final thoughts;

- Frequently Asked Questions.

- UP NEXT

- REFERENCES

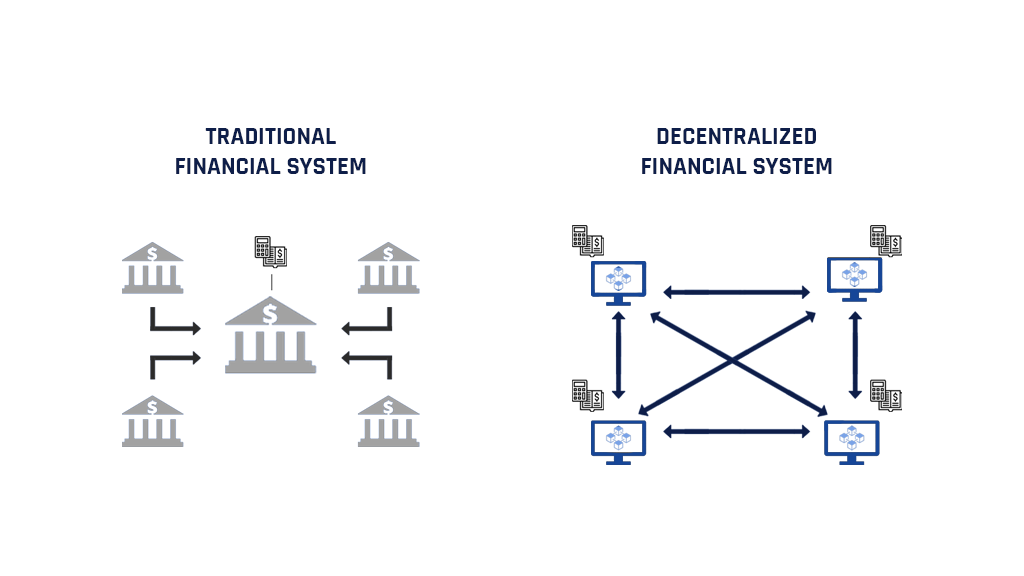

Decentralized finance, or “Defi” for short, is a term used to describe financial products and services that are not controlled or regulated by any central authority. Its peer-to-peer finance is enabled by decentralized technologies built on the blockchain. More specifically, DeFi allows users to take advantage of traditional banking services, such as borrowing, trading, and lending, with increased anonymity and speed. Defi products and services are powered by distributed ledger technology (DLT) and rely on a network of computers to verify and execute transactions. It’s a shift away from traditional, centralized financial systems (like banks) and has many benefits over them.

bACKGROUND:

Some of the most popular products include decentralized exchanges (DEXs), decentralized lending platforms, and decentralized asset management platforms. DEXs are exchanges that allow users to trade cryptocurrencies and other digital assets without relying on a third party to facilitate the transaction. Decentralized lending platforms allow users to borrow and lend money without having to go through a bank or other financial institution. And decentralized asset management platforms allow users to store and trade digital assets in a secure, trustless environment.

Additionally, The popularity of Defi products and services is due in part to the growing awareness of the benefits of blockchain technology. Blockchain is a distributed ledger that allows for secure, transparent, and tamper-proof transactions. This makes it an ideal technology for powering Defi products and services. Additionally, NFT trading largely takes place over DeFi, and the evolving metaverse is integrating with DeFi also. As the Defi ecosystem continues to grow and evolve, it is likely that we will see more and more businesses and individuals adopting this new way of doing finance.NFT trading largely takes place over

The popularity of these products and services is due in part to the growing awareness of the benefits of blockchain technology. Blockchain is a distributed ledger that allows for secure, transparent, and tamper-proof transactions. This makes it an ideal technology for powering Defi products and services.

In addition, the rise of stablecoins has also played a role in the popularity of Defi. Stablecoins are digital assets that are pegged to a fiat currency or other asset, such as gold. This peg ensures that the value of the stablecoin remains relatively stable, even when the prices of other cryptocurrencies fluctuate. This makes stablecoins an ideal currency for use in these products and services.

The growing popularity has led to the development of a number of new platforms and protocols that are designed to power products and services. Some of the most popular Defi platforms include PancakeSwap, Uniswap, and Trader JOE. These platforms provide the infrastructure necessary to build and launch arrays of products and services.

The rise of Defi has the potential to revolutionize the financial industry. By providing a more secure, efficient, and trustless way of conducting financial transactions, it could upend the traditional financial system. This could lead to lower costs, faster transaction times, and greater access to financial products and services for users around the world.

You can do things like borrow and lend crypto, trade without an exchange, and earn interest on your digital assets. And because it’s all built on decentralized, open-source blockchains with smart contract functionality like Ethereum Avalanche and Polygon, you can do it without giving up control of your private keys. In Fact, you can’t use them without your private Keys

So whats the big deal with DEFI exactly?

For starters, it’s open to anyone with an internet connection. There are no geographic restrictions or KYC/AML requirements.

Second, apps are built on blockchains, which means they’re powered by smart contracts. This makes them more transparent and trustworthy than traditional financial services, which often rely on opaque, centralized systems.

Finally, it’s still in its early stages, which means there’s a lot of room for growth and innovation. We’re just beginning to scratch the surface of what’s possible.

Examples of DeFi platforms:

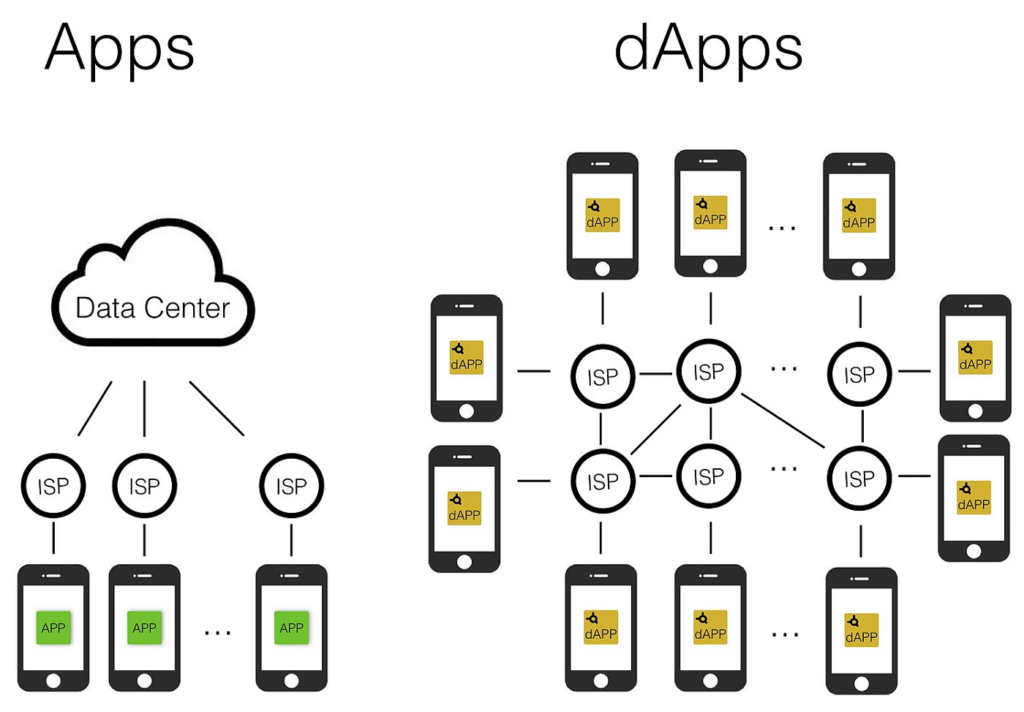

dapps

A dapp, or decentralized app, uses blockchain technology to protect user data from being collected and sold. They run autonomously and often serve the same function as traditional apps for social media, games, and related purposes.

They are often built on blockchain or other distributed ledger systems, and they use smart contracts to enable their functionality.

Like traditional applications, DApps provide some function or utility to users. However, because they are decentralized, they are not subject to the control of any central authority.

This gives DApps a number of advantages over traditional applications, including increased security and transparency. Defi is a great example of a successful DApp that has been built on the Ethereum blockchain.

By deployed smart contracts on the Ethereum network, Defi brings a whole new level of financial inclusion to users around the world.

Defi applications are changing the way we think about finance, and they have the potential to revolutionize many other industries as well.

DAOs:

Courtesy of Ledger

Sometimes considered a type of dapp, DAOs, or decentralized autonomous organizations, are a new type of organization that relies on blockchain technology to give all token holders a say in important decisions. Rather than trusting a single CEO or board of directors, DAOs allow all stakeholders to vote on important matters such as how to allocate funds or what new features to add.

This approach has many advantages, including improved transparency and accountability, but it also comes with some risks. For example, if a DAO’s tokens are stolen or hacked, the organization could be bankrupted overnight.

Defi projects are popping up everywhere you look. From yield enhancement protocols to lending platforms, decentralized autonomous organizations (DAOs) are changing the way we interact with the digital world.

But what exactly is a DAO?

In short, a DAO is an organization that is constructed by rules encoded as a computer program. These rules are often transparent and controlled by the organization’s members, rather than being influenced by a central government. This decentralized structure allows DAOs to operate more efficiently and democratically than traditional organizations. As Defi continues to grow in popularity, it’s worth keeping an eye on the rise of DAOs. Who knows – they may just change the world as we know it.

Exchanges:

Exchanges are a critical component of the crypto ecosystem, allowing users to buy, sell, and trade digital assets 24/7. While some exchanges only support crypto-to-fiat trading, others also allow users to convert their fiat currency into cryptocurrency, giving them access to the broader world of Defi and decentralized applications. Exchanges can be either centralized or decentralized. In a centralized exchange, a third party helps to conduct transactions, while in a decentralized exchange, smart contracts are responsible for processing sales and trades. Both types of exchanges have their advantages and disadvantages, but ultimately they provide an essential service for those looking to enter the world of cryptocurrency..

Lending Platforms:

Lending platforms allow you to take out crypto-backed loans.

Defi lending platforms allow users to take out crypto-backed loans. These users can also offer loans to other investors and achieve “crypto dividends” as interest.

Many users prefer taking out these loans over more traditional ones because they don’t require credit checks and can also be obtained fairly quickly. Defi lending platforms have become popular in recent years as a way to earn interest on your digital assets without having to sell them.

However, these platforms are still relatively new and there is some risk involved in using them.

The main risk being that Crypto yield is based off of trading and most projects have no real defined value to provid real world yield.

A lot of this is an experiment

Nonetheless, Defi lending platforms offer a unique opportunity for investors to earn passive income on their digital assets.

**Always Always Always Read the fine print before putting your crypto into any yield generating platform**

Wealth Management Platforms:

Crypto IRAs are one of the newest and greatest ways to get in on the Defi action. Along with providing increased portfolio diversification, crypto IRAs offer tax benefits for both ROTH and traditional accounts. Defi is all about earning interest on your crypto holdings, and with a crypto IRA, you can do just that without having to worry about Uncle Sam coming after you for taxes. So if you’re looking for a way to supercharge your wealth-generation potential, a crypto IRA is definitely worth considering.

What’s the difference between DeFi and CeFi?

CeFi stands for “centralized finance,” which refers to traditional financial services like banks and exchanges. In contrast, DeFi is “decentralized finance,” which refers to the emerging world of peer-to-peer finance enabled by decentralized technologies.

Here are a few key ways CeFi and DeFi differ:

CeFi is centralized, while DeFi is decentralized. With CeFi, you have to trust a central authority to keep your funds safe and to follow the rules. With DeFi, there is no central authority; instead, trust is placed in code that is running on the Ethereum blockchain.

CeFi is closed, while DeFi is open. CeFi services are often restricted to certain countries or jurisdictions. DeFi services, on the other hand, are available to anyone with an internet connection.

CeFi is slow, while DeFi is fast. CeFi services often involve slow, manual processes that can take days or weeks to complete. DeFi services, on the other hand, are often near-instant and automated.

What’s the difference between DeFi and traditional finance (Tradfi)?

DeFi is decentralized, while Tradfi is centralized. There is no central authority; instead, trust is placed in code that is running on the Ethereum blockchain. Tradfi, on the other hand, relies on central authorities like banks and governments.

DeFi is open, while Tradfi is closed. DeFi services are available to anyone with an internet connection. Tradfi, on the other hand, is often restricted to certain countries or jurisdictions.

DeFi is transparent, while Tradfi is opaque. DeFi apps are built on the Ethereum blockchain, which means they’re powered by smart contracts. This makes them more transparent and trustworthy than traditional financial services, which often rely on opaque, centralized systems.

As with any emerging technology, there are some risks associated with DeFi:

Cefi fake out: Centralized finance disguising itself as decentralized finance is a very big problem in this crypto cycle. Some projects claim to be “decentralized” but are actually centrally controlled. These projects might use decentralized infrastructure like the Ethereum blockchain, but they have centralized control over the project itself. This can be a risk because it defeats the purpose of using decentralized technologies in the first place.

Volatility: The price of Ethereum (and other cryptocurrencies) is highly volatile, which means the value of your assets can go up or down quickly. This makes DeFi a risky investment, and you should only invest what you can afford to lose.

Hacks: dapps are still new and untested, which makes them a prime target for hackers. If you use one, make sure to do your research and only use apps that have a good reputation.

Loss of funds: If you lose your private keys, you will lose access to your account and any assets it contains. This is why it’s important to store your private keys in a safe place.

What are some of the most popular defi applications?

Courtesy of https thenewscrypto.com

- Battle Infinity (IBAT) – ADeFi Coin Project in 2022;

- TamaDoge – A Young Crypto Project;

- Lucky Block (LBLOCK) – A new DeFi Coin for Passive Income;

- DeFi Coin (DEFC) – A DeFi Coin for Staking;

- Cosmos (ATOM) – A Crypto Project Connecting Blockchains;

- UniSwap (UNI) – Most popular DeFi Coin by Market Cap;

- Cardano (ADA) – The top DeFi Coin for Innovation and Security;

- Decentraland (MANA) – The real DeFi Metaverse Enthusiasts.

What are the benefits of using defi applications?

There are a number of benefits that come with using defi applications. Firstly, they allow users to access financial services in a decentralized manner. This means that there is no need for a central authority to provide these services.

Secondly, defi applications often offer users lower fees than traditional financial service providers. This is due to the fact that they are powered by smart contracts which automate many of the processes involved in providing these services.

Finally, defi applications can offer a higher degree of security than traditional financial service providers as they are built on top of the Ethereum blockchain.

Outtlook and final thoughts;

The future of defi looks bright. With more and more people beginning to use these applications, it is likely that we will see an increase in the number of services that are offered on these platforms. This will provide users with even more choices when it comes to accessing financial services in a decentralized manner. In addition, as the technology behind these applications continues to develop, we are likely to see even more innovation in this space. This could lead to the creation of new and exciting defi applications that we have not even thought of yet.

If you’re interested in learning more about defi, check out our Crypto 101 series. In this series, we’ll be exploring the basics of decentralized finance and how you can get started using defi products and services. Stay tuned for more!

If you’re interested in learning more about defi, check out our Crypto 101 series. In this series, we’ll be exploring the basics of decentralized finance and how you can get started using defi products and services. Stay tuned for more!

Frequently Asked Questions.

Decentralized finance, or defi, is a term used to describe financial services that are offered in a decentralized manner. This means that there is no need for a central authority to provide these services.

There are a number of benefits that come with using defi applications. Firstly, they allow users to access financial services in a decentralized manner. This means that there is no need for a central authority to provide these services. Secondly, defi applications often offer users lower fees than traditional financial service providers. This is due to the fact that they are powered by smart contracts which automate many of the processes involved in providing these services. Finally, defi applications can offer a higher degree of security than traditional financial service providers as they are built on top of the Ethereum blockchain.

The future of defi looks bright. With more and more people beginning to use these applications, it is likely that we will see an increase in the number of services that are offered on these platforms. This will provide users with even more choices when it comes to accessing financial services in a decentralized manner. In addition, as the technology behind these applications continues to develop, we are likely to see even more innovation in this space. This could lead to the creation of new and exciting defi applications that we have not even thought of yet.