HI THERE DENIZENS, AND WELCOME BACK!

Why Crypto crashed IN 2021

The short answer is the Federal Reserve. On November 3 2021 everything changed. The Fed announced it was going to begin “tapering” its asset purchases. From this point forward, the Fed rapidly pulled back and started increasing interest rates. This was the event horizon, ground zero for the kickoff that started this historical macro fear marathon and record-breaking crash across all market sectors. Bitcoin’s volatile drop initiated an epic cascading crash effect across the cryptoverse that not only resulted in a 75% drop in Bitcoins value but also lead to the collapse of TerraLuna, Celsius, and defi in general. In retrospect, all the warning signs out of control inflation were everywhere and the fed was warning us that they were going to completely shift direction and stop the printer. But Based on my understanding of why 95% of all experts in the financial world didn’t see this epic crash coming was not that they didn’t see the signs, but rather that they didn’t believe in the Fed’s resolve to combat the inflation that it had created. And to be honest, most of us in the cryptoverse wasn’t paying attention to the MACRO environment, mainly out of, let’s be honest, hubris. Most of us nonmacro crypto “degens” simply thought that crypto assets had de-pegged from conventional markets.

Basically everyone, well most, ignored Fed warnings. Network effects of the internet in the mind 90’s we are experiencing a crash that resembles the dot-com bubble of the late 90’s. Cryptocurrencies have suffered a brutal comedown this year, losing $2 trillion in value since the height of a massive rally in 2021.

Honestly, it’s not even that complicated to understand why Crypto crashed, how everything changed, and why it’s a good thing;

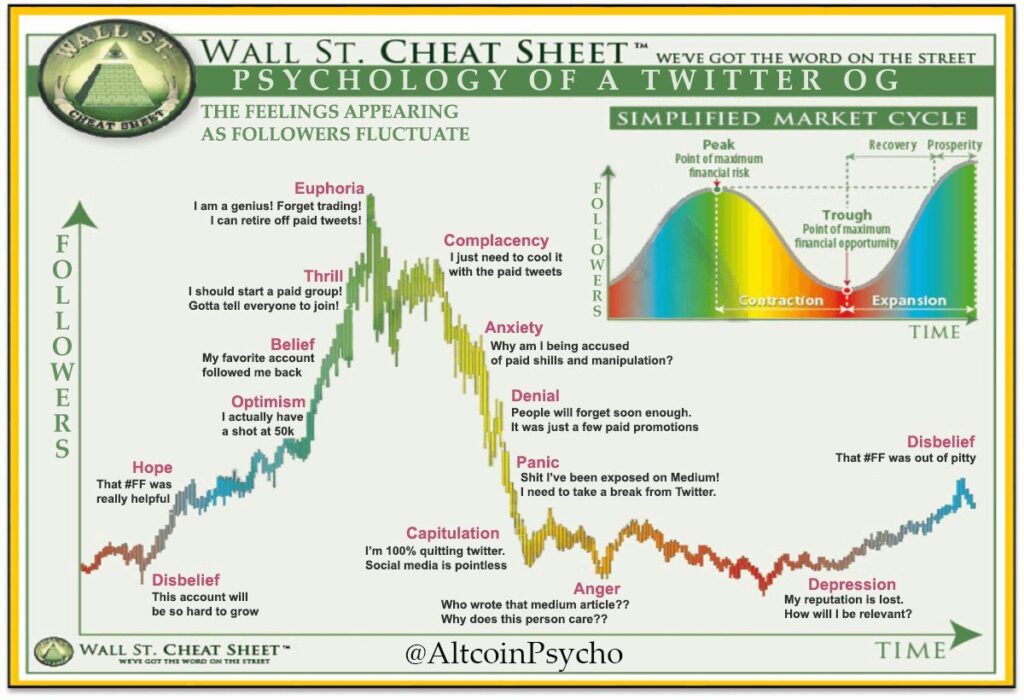

A few weeks into the crypto crash that started at the end of 2021, I remember being extremely annoyed at all of the experts I admired, follow, and trusted. I remember asking myself “why the hell didn’t any of them see this coming”.

This wasn’t entirely true as a few of them were extremely cautious and pragmatic, but my point is that 95% of these millionaire and billionaire pros that I was following didn’t see it. To be fair, I couldn’t be too angry because as many of you know, all investment responsibility is ultimately in the hands of the individual investor.

But to add insult to injury, after educating myself, my frustration grew because it not only became obvious to me that this crash was coming but it could literally be predicted within a 6-week time frame.

So whats the big deAL?

How everything changed

The crypto crash has been brutal. Markets have plummeted and many large entities were not prepared for the rapid reversal. The crypto market has been flooded with debt thanks to the emergence of centralized lending schemes and so-called “decentralized finance.”

The collapse of the algorithmic stablecoin terraUSD and the contagion effect from the liquidation of hedge fund Three Arrows Capital highlighted how interconnected projects and companies were in this cycle.

It’s still too early to tell how severe the damage will be, but one thing is clear: this crypto crash has been unlike any other…..or is it?

The crypto world is currently in the midst of a bear winter component of a large growth cycle. These cruel bear markets happen every few years and cause a lot of changes in the industry.

The last big cycle was in 2017 when Bitcoin hit $20,000 for the first time.

That set off a frenzy of activity and investment that led to euphoric market conditions which preceded the infamous collapse down to $3500.. ouch

This time around, the cycle started when Bitcoin hit $20,000 in December 2020. That set off a new wave of investment and speculation, driving prices up across the board. Ethereum, Ripple, Litecoin, and other major coins all saw huge gains in the months that followed.

The current cycle is different from 2017 in a few key ways. First, the amount of money flowing into the market is much higher. In 2017, the total market cap of all cryptocurrencies was around $13 billion. Today, it’s over $1 trillion. That’s an increase of over 7,000%.

Second, the influx of new investors is also different. In 2017, most of the money came from individual investors. This time, institutional investors are playing a big role. Companies like Square and Tesla have invested billions of dollars in Bitcoin. hedge funds are getting involved as well.

Third, the overall market conditions are different. In 2017, there was a lot of hype and speculation around Bitcoin. Today, there’s more interest in the underlying technology and its potential uses. This is driving more sustainable growth in the market.

The current crypto cycle has caused a lot of changes in the industry. New investors have come in, and the overall market conditions are different. It’s still early days, but this cycle looks like it could be good for the long-term growth of the industry.

why it's a good thing

“People participating in crypto asset markets are not as well-informed as they should be. Calls for greater transparency seem well-grounded. Perhaps unique to these markets is the implicit trust that people place in the computer codes that make up the blockchains and smart contracts that underlie cryptocurrencies and crypto assets. Few people are able to audit these, so industry standards appear long overdue.”-Mark Jamison

This crash was like a tsunami that exposed and washed away all of the unstable projects, weak project teams, and scams.

Bitcoin, the world’s biggest digital coin, is off 70% from a November all-time high of nearly $69,000.

Cryptocurrencies have suffered a brutal comedown this year, losing $2 trillion in value since the height of a massive rally in 2021.

Bitcoin and the cryptocurrency market more broadly have been trading in a closely correlated fashion to other risk assets, in particular stocks. Bitcoin posted its worst quarter in more than a decade in the second quarter of the year. In the same period, the tech-heavy Nasdaq fell more than 22%.

But this is a good thing. Crypto is beginning to resemble the network effects of the internet in the mind 90’s and we’re experiencing a crash that resembles the dot-com bubble of the late 90’s.

Although It’s true that this crippling crash has resulted in many experts warning of a prolonged bear market known as “crypto winter.”, similar to the last such event that occurred between 2017 and 2018, there’s something about the latest crash.

What makes it different from previous downturns in crypto — the latest cycle has been marked by a series of events that have caused contagion across the industry because of their interconnected nature and business strategies.

Back in 2018, bitcoin and other tokens slumped sharply after a steep climb in 2017.

The market then was awash with so-called initial coin offerings, where people poured money into crypto ventures that had popped up left, right and center — but the vast majority of those projects ended up failing.

“The 2017 crash was largely due to the burst of a hype bubble,” Clara Medalie, research director at crypto data firm Kaiko, told CNBC.

But the current crash began earlier this year as a result of macroeconomic factors including rampant inflation that has caused the U.S. Federal Reserve and other central banks to hike interest rates. These factors weren’t present in the last cycle.

That sharp reversal of the market caught many in the industry from hedge funds to lenders off guard.

Institutional investors are starting to take notice of crypto, and some big names have been investing in the space. For example, hedge fund manager Tim Draper has been a big supporter of Bitcoin, and he’s even predicted that it will reach $250,000 by 2023.

Outlook and final thoughts;

The current crypto crash is far different from any other because it’s being caused by macroeconomic factors, and it’s happening at a time when institutional investors are starting to take notice of the space. This could be good for the long-term growth of the industry. As more people begin to notice that our money is irreparably broken and there’s no traditional finance, government, or institutional solution in existence that doesn’t involve tyranny, The signs that the general public is becoming more interested in Bitcoin and crypto are beginning to become more evident. Google searches for “Bitcoin” have been rising steadily over the past year, and there’s been a surge in interest in Ethereum, which is the second-largest cryptocurrency by market cap. What do you think about this crash? Let me know in the comments below!

Frequently Asked Questions.

The current crypto crash is caused by Fed-induced macroeconomic factors, and it’s happening at a time when institutional investors are starting to take notice of the space. This could be good for the long-term growth of the industry.

The macroeconomic factors that are causing the current crypto crash include inflation, interest rates, and the U.S. Federal Reserve.

The current crypto crash could be good for the long-term growth of the industry because it’s attracting more attention from institutional investors.

**Disclaimer**

Cryptocurrencies and ICOs are all the rage these days, with everyone from celebrities to your next door neighbor looking to get in on the action. However, it’s important to remember that investing in cryptocurrencies and ICOs is highly risky and speculative. The prices of these assets can be incredibly volatile, and there’s no guarantee that you’ll make any money by investing in them. In fact, you could easily lose everything that you put into them. So if you’re thinking about investing in cryptocurrencies or ICOs, make sure that you understand the risks involved and only invest what you can afford to lose.

How to follow crypto news

Your comment is awaiting moderation.